Some individuals enjoy doing fast trades during the day, responding to each little fluctuation in price. Different people like to be more patient and analyze the market for larger gains after a longer time.

This manual assists you in locating the best crypto trading strategies that fits your preferences, be it rapid trading or a considered approach for the long term.

Best Trading Strategies for Crypto

The best strategies are essential for crypto trading. Additionally, discovering the best-decentralized exchanges can give you more control and privacy in your transactions. You can also learn which cryptocurrencies are best for mining to optimize your investment opportunities.

Buy and Hold – One of the Best Crypto Trading Strategies

Many investors in cryptocurrency follow the Buy and Hold approach, keeping their investments for an extended period.

People who use this cryptocurrency trading strategy in their money management stick to the belief in the future rewards of cryptocurrencies over a long time. This approach, widely known as ‘Hold on for Dear Life’ or HODL, really tests how much investors trust and can endure and wait patiently.

Day Trading

An alternative investment approach gaining popularity to keeping investments for a long time is called Day Trading. This method involves investors paying attention to minor changes in the market with the goal of making rapid profits through frequent transactions.

A strategy for buying and selling cryptocurrency within the same day’s trading session has become more popular because it separates crypto from the financial markets’ volatility. This can make following this strategy quite profitable one of the most profitable crypto trading strategies.

DCA

A method that pushes investors to save money is the Dollar Cost Averaging approach, where individuals put a constant sum into cryptocurrencies at set times. This establishes a habit for the investors similar to when they invest in other usual types of investments such as SIPs or Fixed Plans.

Having this routine will make the crypto investment collection more stable and smooth out the ups and downs of the cryptocurrency market, which can adjust or fix previous financial plans if necessary.

Buy Low, Sell High

Many people who invest in cryptocurrency are now starting to use cryptocurrency trading strategies for beginners where they buy when the price is not high and then wait until the value goes up a lot before selling it, which can lead to making good profit.

To succeed with this method, it is not easy. Investors apply instruments and algorithms such as indicators to examine and follow how a group of cryptocurrencies moves. The moving average that we often look at every month or week is what many people use to follow the patterns as time goes by.

Arbitrage

Arbitrage trading is a method where traders buy and sell on different platforms or exchanges.

In this kind of trading, they buy cryptocurrency from one exchange where it has a lower price, and then when they decide to sell, they choose an exchange with a higher price than the one where they originally bought the crypto.

Scalping

Scalping is a fast trading strategy in which traders aim to gain little profits from small changes in prices. These traders, known as scalpers, carry out numerous trades within the day and typically hold their positions for just minutes or seconds.

This method requires quick moves and sharp attention because the profit from every transaction is little, hence they must execute numerous trades for a significant total.

Scalping is very helpful in strategies for trading cryptocurrencies because the markets of cryptocurrency move quickly.

Common Risk Management Mistakes in Crypto Trading

Understanding from past errors is a good yet expensive method for achieving success. Crypto trading, as with other kinds of trade, relies on transparent concepts and tactics that every trader in cryptocurrencies should follow, especially those who are just starting.

If you have just started buying or trading in cryptocurrency, here are some usual errors traders do that it’s good for you to stay away from:

Doing business in the market without a definite strategy and objective can cause financial loss. Think about how much money you want to make, what level of risk you are comfortable with, and how long you plan to invest when creating your trading approach.

The market for cryptocurrencies is very unstable. Thinking about investments for the longer term tends to be more advantageous.

If you diversify too much, you might end up with a lot of investments that do not perform well. Make sure to spread your money across different investments only if you really grasp the basic rules and ideas behind them.

New traders need to pick an exchange that is reliable, safe and has a good reputation. Many times they do not pay enough attention to the trustworthiness and security aspects.

Not knowing the basic and detailed study of market trends might cause you to lose money. It is advised that you acquire knowledge about these analyses of the market before beginning your trading journey.

Putting in money that you cannot afford to lose. Cryptocurrency has big ups and downs, so there is a lot of risk for losing lots. Know the dangers and prepare yourself for if things go very bad.

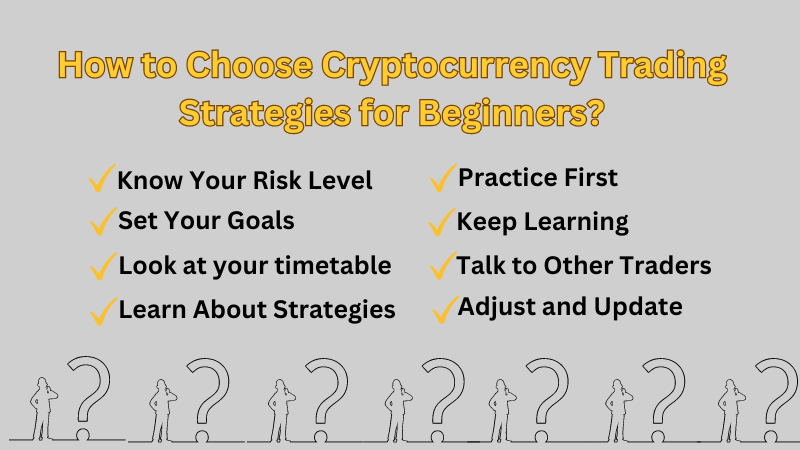

How to Choose Cryptocurrency Trading Strategies for Beginners?

Know Your Risk Level. Determine whether you are comfortable with taking large risks for the possibility of large rewards, or if you rather choose to avoid risk. This will assist in selecting a strategy that fits your comfort level.

Set Your Goals. Consider your goals in trading. Are you seeking immediate gains or growth over an extended period? Your goals will help you choose the right approach.

Look at your timetable. Certain plans require much time, for example day trading, that demands constant market observation. Make sure you have enough time for the strategy you choose.

Learn About Strategies. Study various methods such as trading during the day, holding trades for a period of time and making quick transactions. Grasp their mechanisms and the instruments they employ.

Practice First. Try using a demo account to test strategies without the risk of losing actual money. It allows you to discover what is effective for your approach.

Keep Learning. The cryptocurrency market often changes. Keep up with the latest trends and tools to make your trading better.

Talk to Other Traders. When you become part of a trading group, it can provide fresh ideas and allow learning from what others have gone through.

Adjust and Update as Necessary. At times, it is essential to modify your approach so that it aligns with the market or meets your objectives. Always check how your strategy is doing and be ready to make changes.

Conclusion of Best Trading Strategies for Crypto

To trade in cryptocurrencies effectively, you need to know how the market works, control your risk well and select a crypto trading strategy that fits with what you want to achieve and suits your way of living.

To get better at trading, it is important to keep up with information, practice regularly and adjust to new conditions in the market.

Remember, to trade well you don’t need to win every time but the key is making smart choices and taking care of your investments for success over a long period.

FAQs About The Best Crypto Trading Strategies

What is the most profitable crypto trading strategy❓

The most profitable crypto trading strategy varies for each person, but many find success with day trading because it uses the market’s quick changes. However, it needs a lot of attention, knowledge, and good risk management. The best strategy is one that fits your goals and comfort with risk.

Can beginners profit from crypto trading❓

Yes, beginners can make money with crypto trading, but it requires learning about the market, starting with small investments, and using risk management strategies to minimize losses.

Do I need bots for crypto trading❓

No, bots are optional; many trade successfully without them.

Is technical analysis important in crypto trading❓

Yes, it’s key for making informed decisions.

Must I know about blockchain to trade crypto❓

No, but basic knowledge is beneficial.

What is the main best strategy for trading cryptocurrency❓

The main strategy for trading cryptocurrency is to conduct thorough research and analysis before making trades.