The best decentralized exchanges (DEXs) have transformed cryptocurrency trading by eliminating intermediaries. Unlike traditional exchanges, DEXs let users trade directly, giving them full control over their funds and enhancing security.

In this article, we’ll explore the best decentralized crypto exchanges of [year] and discuss why investing in DEXs is a smart choice.

List of Decentralized Exchanges (DEXs): TOP 5

Here is the top decentralized exchanges list, focusing on their features, benefits, and user experiences.

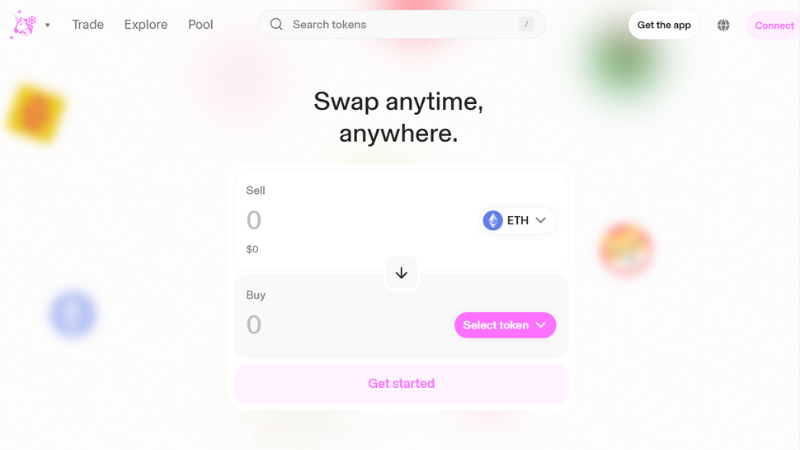

Uniswap

Uniswap is one of the best decentralized crypto exchanges, known for being the first to introduce automated market maker (AMM) technology. It’s designed to be user-friendly, making it accessible for both beginners and experienced traders.

With a broad range of Ethereum-based tokens, Uniswap allows for decentralized, permissionless trading directly from your crypto wallet—no account needed.

The platform is popular for its reliable trades, low slippage, and continuous updates, keeping it at the forefront of the DeFi space.

- Rating: ★★★★★ 10/10

- Founded: 2018

- Daily Volume: $1 billion+

- Supported Tokens and Network: ERC-20 tokens on Ethereum

- Trading Fees: 0.3% per trade

- Liquidity Pools and Rewards: Available for multiple token pairs

- Website: Uniswap

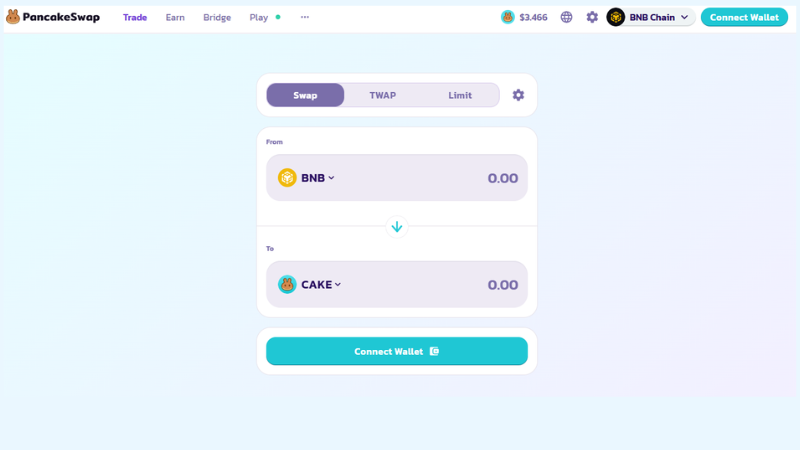

PancakeSwap

PancakeSwap, one of the top DEXs on the Binance Smart Chain (BSC), is renowned for its low fees and broad support for BEP-20 tokens. Users can earn substantial rewards through its liquidity pools, and the platform’s simple design is easy to navigate.

Features like lotteries and NFT collectibles add a fun, gamified element, making PancakeSwap an ideal choice for those who prioritize low fees and BSC compatibility.

- Rating: ★★★★☆ 9/10

- Founded: 2020

- Daily Volume: $500 million+

- Supported Tokens and Network: BEP-20 tokens on Binance Smart Chain

- Trading Fees: 0.2% per trade

- Liquidity Pools and Rewards: Extensive for BEP-20 tokens

- Website: PancakeSwap

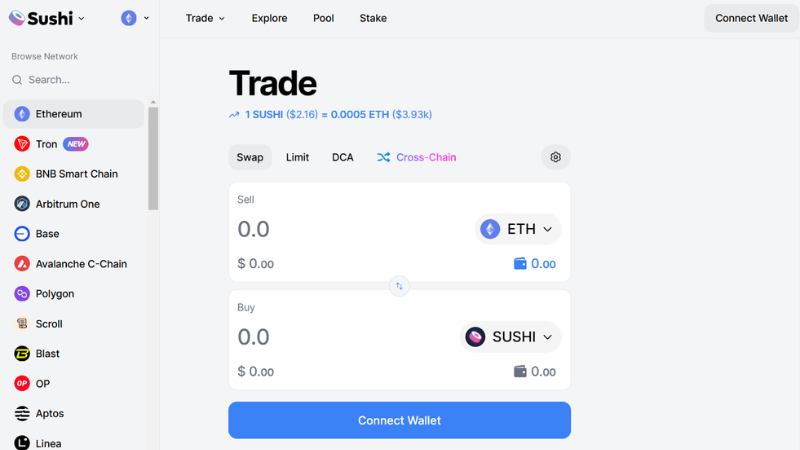

SushiSwap

SushiSwap is one of the best DEX crypto that makes cross-chain trading easy, letting users swap tokens across multiple blockchains. This flexibility is great for those who want more options beyond just one network.

This one of the best decentralized cryptocurrency exchanges rewards users who add liquidity with “SUSHI” tokens, providing a way to earn extra income.

SushiSwap also offers features like yield farming and staking, making it appealing for users looking to grow their crypto holdings. With regular updates, SushiSwap stays competitive and user-friendly.

- Rating: ★★★★☆ 8.5/10

- Founded: 2020

- Daily Volume: $300 million+

- Supported Tokens and Network: Ethereum-based and cross-chain with Avalanche, Polygon, and others

- Trading Fees: 0.3% per trade

- Liquidity Pools and Rewards: Yes, with attractive staking options

- Website: SushiSwap

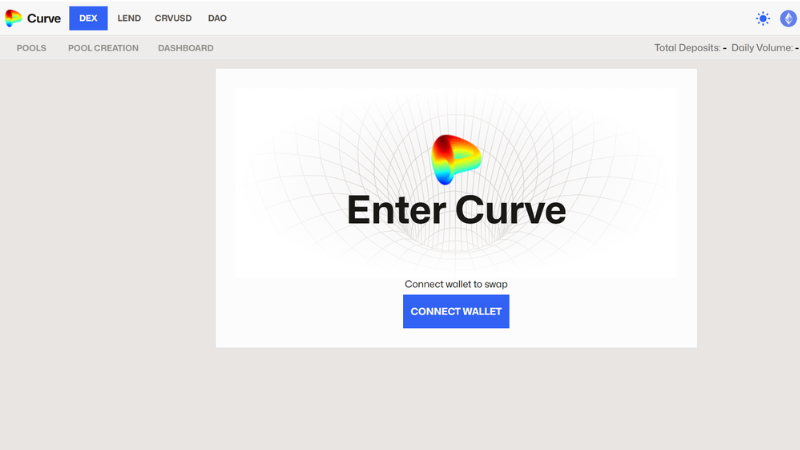

Curve Finance

Curve specialises in stablecoin trading. This decentralized cryptocurrency exchange provides competitive fees and minimal slippage for stable asset trades. The platform focuses on stablecoins and yield opportunities.

This makes it a top choice for users looking to maximise returns on low-volatility assets. Curve Finance is ideal for stablecoin traders seeking efficient trades and dependable rewards.

- Rating: ★★★★☆ 9.5/10

- Founded: 2020

- Daily Volume: $200 million+

- Supported Tokens and Network: Stablecoins on Ethereum are essential. They ensure reliable trading and liquidity.

- Trading Fees: Low fees tailored for stablecoin trades

- Liquidity Pools and Rewards: Focused on stablecoin pairs with attractive yields

- Website: Curve

Balancer

Balancer stands out with its customizable liquidity pools, allowing users to create pools with up to eight tokens. This DEX exchange offers a flexible approach to trading and yield generation, which is ideal for users who want to tailor their trading and pooling strategies.

This customization enables greater flexibility and optimized rewards, making Balancer a powerful choice among DEX exchanges.

- Rating: ★★★☆☆ 8/10

- Founded: 2020

- Daily Volume: $150 million+

- Supported Tokens and Network: Ethereum and supported ERC-20 tokens

- Trading Fees: Variable, based on liquidity pool

- Liquidity Pools and Rewards: Customizable pools with high flexibility

- Website: Balancer

Best DEXs for Different Use Cases

| Use Case | Best DEXs | Description |

| For Beginners | Uniswap, PancakeSwap | Simple, user-friendly interfaces make these DEXs ideal for newcomers. |

| For Advanced Traders | dYdX | Offers advanced features like margin trading and leverage for experienced users. |

| For Low Fees | PancakeSwap | Built on Binance Smart Chain (BSC), providing low transaction fees compared to Ethereum-based DEXs. |

| For Cross-Chain Trading | ThorChain, SushiSwap | It allows direct asset swaps across different blockchains, which is ideal for multi-chain trading. |

| For Privacy-Focused Users | Incognito, SecretSwap | Uses privacy protocols to ensure transactions remain confidential. |

| For Earning Passive Income | Curve Finance, Balancer | Specialized liquidity pools offer steady yield opportunities for liquidity providers. |

| For NFT Enthusiasts | Rarible, OpenSea | Decentralized NFT marketplaces where users can buy, sell, and trade NFTs without intermediaries. |

| For High-Speed, Low-Cost Trades | QuickSwap, PancakeSwap | Built on layer-2 solutions or alternative chains, providing fast and affordable transactions. |

| For Governance Participation | Uniswap, SushiSwap | Token holders can vote on platform updates, making it great for those wanting a say in DEX development. |

| For Stablecoin Trading | Curve Finance | Optimized for stablecoin trades, minimizing slippage and impermanent loss for stable asset swaps. |

What is a Decentralized Cryptocurrency Exchange?

A decentralized cryptocurrency exchange (DEX) lets people trade crypto without a central authority or intermediaries. Here’s how it works:

- Control Over Funds: DEXs operate on blockchain networks using smart contracts to execute trades. This setup allows users to control their crypto at all times.

- Self-Custody: Unlike traditional exchanges, DEXs let traders manage their own crypto and private keys. This reduces the risk of hacks and increases security.

- No Middleman: Smart contracts handle trades automatically, removing the need for a middleman. This setup makes trading more transparent and flexible for users.

- Modern Technology: Many DEXs use Automated Market Makers (AMMs) and liquidity pools instead of traditional order books. AMMs rely on trading volume to create liquidity, helping DEXs match buyers and sellers more smoothly.

Understanding the Different Types of Crypto Decentralized Exchanges (DEXs)

Automated Market Makers (AMMs)

What They Are: AMMs like Uniswap, PancakeSwap, and Curve use algorithms to set token prices and enable trades. Instead of traditional order books, they rely on liquidity pools, where users deposit tokens to facilitate trading.

Benefits: Simple to use, especially for beginners, and lets users earn fees by adding liquidity.

Best For: Users who want easy trading of popular tokens and a way to earn passive income.

Order Book DEXs

What They Are: These DEXs, like dYdX and Loopring, use an order book where buy and sell orders are listed, similar to traditional exchanges.

Benefits: Often operate on layer-2 solutions (like dYdX on Ethereum layer-2) for faster and cheaper transactions; many also support advanced trading features like margin trading.

Best For: Advanced traders who want precise control over prices and trade volume.

DEX Aggregators

What They Are: Aggregators like 1inch and Matcha scan multiple DEXs to find the best prices. They help users find the lowest fees and most favorable rates for trades.

Benefits: Quick, cost-effective, and ensures users get the best deals without manually checking multiple platforms.

Best For: Traders looking for the lowest costs and best prices on trades.

Peer-to-Peer (P2P) DEXs

What They Are: P2P DEXs, like LocalCryptos, let users trade directly with each other instead of relying on liquidity pools.

Benefits: Users can negotiate prices directly; often suggests more privacy and sometimes alternative payment options like cash.

Best For: People who prefer direct trading with others or prioritize privacy in their transactions.

Cross-Chain DEXs

What They Are: Cross-chain DEXs, like ThorChain and Anyswap, allow token trading across different blockchains without needing “wrapped” assets.

Benefits: Directly supports trading between blockchains like Bitcoin, Ethereum, and Binance Smart Chain, making it easy for users with assets on multiple networks.

Best For: Users with assets on various blockchains who want a straightforward way to trade between them.

Why Consider Investing in the Best DEX?

To make the most of your trades on a DEX, you may want to explore some of the best crypto trading strategies, which can help you maximize returns and minimize risks. Investing in the best decentralized exchanges provides multiple advantages compared to traditional platforms.

Privacy and Security

Decentralized exchanges let users trade directly from their crypto wallets, keeping personal information secure and private. There’s no need for KYC processes, reducing the risk of data breaches.

Censorship Resistance

DEXs offer global accessibility without location-based restrictions. This means anyone with internet access can trade, promoting a more open and inclusive financial system.

Financial Inclusion

DEXs are open to everyone, giving people in underserved regions the opportunity to engage in cryptocurrency trading and access financial opportunities they might not have otherwise.

Asset Control

With DEXs, you maintain full control over your assets. Since the exchange never holds your funds, the risk of losing money due to central authority failures is minimised.

Lower Fees

Transaction fees on DEXs are often lower compared to centralized exchanges, which is appealing to cost-conscious traders. You get to keep more of your earnings.

Passive Income Opportunities

Many DEXs offer ways to earn passive income through liquidity pools and yield farming, allowing users to generate extra earnings on their crypto holdings.

Wide Token Variety

DEXs provide access to a vast range of tokens, including niche and newly launched assets. This gives investors unique opportunities that are often unavailable on traditional exchanges.

Conclusion About Best Decentralized Exchanges in [year]

The best decentralized exchanges (DEXs) have transformed cryptocurrency trading, allowing users to trade directly, securely, and with full control over their assets. By eliminating intermediaries, DEXs enhance privacy, reduce fees, and support a wide range of tokens.

From Uniswap’s user-friendly AMM model to Curve’s stablecoin efficiency, each DEX brings unique strengths. As DeFi grows, the best DEXs will continue to provide flexible, secure, and independent trading options for crypto users worldwide.

FAQs About the Best DEXs

What makes a DEX one of the best❓

The best DEXs offer user-friendly interfaces, low fees, high security, and access to a broad range of tokens. They also provide features like liquidity pools and staking for earning opportunities.

Which DEX is best for beginners❓

Uniswap and PancakeSwap are popular for beginners due to their intuitive design and simple trading processes.

What is a decentralized exchange❓

A DEX is a cryptocurrency exchange that operates without intermediaries, allowing users to trade directly on blockchain networks.

What are the benefits of using a DEX❓

DEXs offer greater privacy, lower fees, a wider range of tokens, and improved security through self-custody.

Can beginners use DEXs❓

Yes, many DEXs like Uniswap and PancakeSwap are beginner-friendly with simple interfaces.